Texas car insurance card template pdf provides a detailed and practical guide for obtaining and utilizing this crucial document. Navigating the requirements, variations, and legal implications of Texas car insurance cards can be daunting, but this resource simplifies the process. Understanding the standard format, essential information, and variations based on policy types is essential for compliance and peace of mind.

This comprehensive guide will provide a clear understanding of the Texas car insurance card template pdf, encompassing all necessary elements, including legal requirements, formatting considerations, and practical application. From creating your own template to downloading ready-made options, we’ll cover all the crucial steps to ensure compliance and convenience.

Template Overview

A Texas car insurance card serves as crucial documentation, verifying your liability insurance coverage. It’s a legally required component for operating a vehicle within the state and provides critical information to law enforcement and other parties in the event of an accident. Understanding its format and content is essential for both drivers and insurance companies.

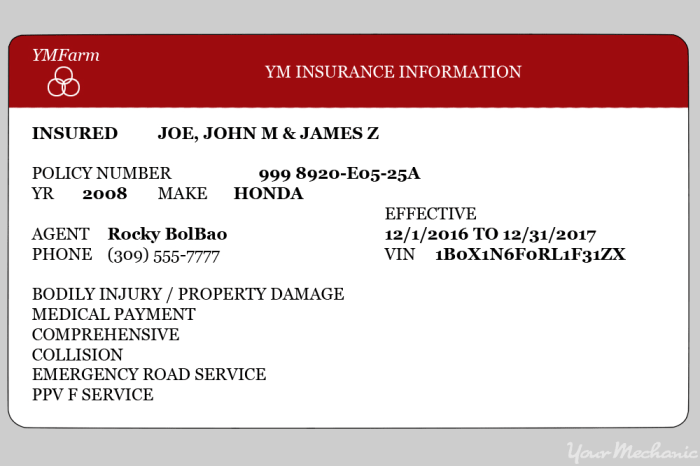

Standard Format and Required Information

Texas car insurance cards adhere to a standardized format, ensuring consistent information presentation. The required information is crucial for verification purposes. This includes details about the policyholder, the insurance company, and the specific coverage details of the policy. Failure to carry a valid card may result in penalties or legal issues.

Common Elements on a Texas Car Insurance Card

Texas car insurance cards typically feature a variety of common elements. These elements work together to convey essential policy details, including crucial contact information and coverage details. These elements are essential for establishing liability and policy specifics.

| Section | Data Points |

|---|---|

| Policyholder Information | Name, Address, Phone Number |

| Insurance Company Information | Company Name, Address, Phone Number, Insurance Policy Number |

| Vehicle Information | Vehicle Identification Number (VIN), Year, Make, Model |

| Coverage Details | Liability Coverage Limits (Bodily Injury and Property Damage), Uninsured/Underinsured Motorist Coverage |

| Policy Effective Dates | Policy Start Date, Policy End Date |

| Agent Information (Optional) | Agent Name, Contact Information |

Sample Texas Car Insurance Card Data Points

The table below exemplifies the kind of data typically found on a Texas car insurance card. Each data point is vital for accurate policy verification and accident reporting.

| Data Point | Example |

|---|---|

| Policyholder Name | John Smith |

| Policyholder Address | 123 Main Street, Anytown, TX 78901 |

| Insurance Company Name | State Farm Insurance Company |

| Policy Number | 1234567890 |

| Vehicle Year | 2023 |

| Vehicle Make | Toyota |

| Vehicle Model | Camry |

| Vehicle VIN | 1A2B3C4D5E6F7G8H9 |

| Liability Limits (Bodily Injury) | $100,000 per person, $300,000 per accident |

| Liability Limits (Property Damage) | $25,000 |

Template Variations

Texas car insurance cards serve various purposes, and their formats can vary depending on the specific policy details and the issuing company. Understanding these variations is crucial for policyholders to ensure they have the correct information and documentation. This section details the common types of Texas car insurance cards and their distinguishing features.The format and content of a Texas car insurance card can differ based on the specific coverage.

This flexibility allows insurance providers to tailor the card to meet the needs of various policy types and conditions. Knowing these differences can prevent confusion and ensure compliance with legal requirements.

Types of Texas Car Insurance Cards

Different types of Texas car insurance policies may have distinct cards, reflecting the nuances of coverage. These variations help ensure clarity and prevent misunderstandings.

- Standard Liability Insurance Card: This is the most common type, covering basic liability requirements for accidents involving the policyholder’s vehicle. The card typically includes the policyholder’s name, address, policy number, and liability limits. This card is the foundation for coverage in case of accidents.

- Comprehensive and Collision Insurance Card: These cards include the same information as standard liability cards, but also detail the coverage amounts for comprehensive and collision damage. The card is essential to ensure proper handling of claims related to damages caused to the insured vehicle, either by accidents or other covered events.

- Uninsured/Underinsured Motorist Insurance Card: This card specifies coverage for damages incurred in accidents caused by drivers without insurance or with insufficient coverage. It clearly states the policyholder’s protection against these types of accidents, which is crucial for ensuring financial security.

- Specialty Insurance Card (e.g., for leased vehicles): Policies for leased vehicles often have specific requirements and associated insurance cards. These cards might contain additional information, such as the lease details or the lessor’s contact information, to handle the specific complexities of leasing situations. The additional details help with smooth claims processing.

Variations in Format and Content

The format and content of Texas car insurance cards can vary depending on the insurance provider and the policy. While the essential information remains consistent, certain details may be presented differently.

| Policy Type | Key Information | Example Data |

|---|---|---|

| Standard Liability | Policyholder’s name, address, policy number, liability limits, vehicle description. | John Doe, 123 Main St, Policy #123456, $25,000 Liability, 2023 Ford F-150 |

| Comprehensive and Collision | Same as Liability plus comprehensive and collision coverage amounts. | John Doe, 123 Main St, Policy #123456, $25,000 Liability, $10,000 Comprehensive, $10,000 Collision, 2023 Ford F-150 |

| Uninsured/Underinsured Motorist | Same as Liability plus coverage amounts for uninsured/underinsured drivers. | John Doe, 123 Main St, Policy #123456, $25,000 Liability, $50,000 Uninsured/Underinsured, 2023 Ford F-150 |

| Specialty (e.g., leased vehicle) | Same as Liability plus lease details, lessor’s contact information. | John Doe, 123 Main St, Policy #123456, $25,000 Liability, Lease Agreement with Acme Leasing, Acme Leasing Contact Info, 2023 Ford F-150 |

Information Required

A valid Texas car insurance card is crucial for demonstrating proof of financial responsibility. It serves as a vital document, verifying that you have the necessary insurance coverage to operate a vehicle legally within the state. Accurate and complete information on the card is essential for both the policyholder and the state.Accurate information is paramount for ensuring that the insurance coverage is correctly represented.

Inaccuracies can lead to complications during traffic stops, accidents, or other interactions with law enforcement or insurance companies. Moreover, omissions can potentially jeopardize the policyholder’s legal rights and protections under the insurance agreement.

Required Information Fields

Accurate and complete information is crucial for a valid Texas car insurance card. Failure to provide the necessary details can result in penalties and complications. Incomplete information on the card can lead to significant legal issues.

- Policyholder Name(s): Full legal names of all policyholders are required for proper identification and verification. This includes the first, middle, and last names. Any discrepancies may cause problems during claims processing or legal proceedings.

- Policy Number: This unique identifier allows insurance companies to access and verify policy details. It’s vital for claims processing and dispute resolution.

- Vehicle Identification Number (VIN): The VIN is a unique alphanumeric code identifying the insured vehicle. It is essential for accurate record-keeping and to prevent fraud. Using a wrong VIN can prevent insurance coverage from applying to the correct vehicle.

- Insurance Company Name: The name of the insurance company issuing the policy is necessary for verification and claim handling.

- Policy Effective Dates: The start and end dates of the insurance policy are required for determining the period of coverage.

- Coverage Limits: Details regarding liability coverage limits are critical for understanding the extent of the insurance policy. Failure to list the appropriate coverage limits may expose the policyholder to financial risk.

- Contact Information: Phone number and mailing address of the policyholder are required for communication purposes and claim processing. Providing incorrect contact details can hinder effective communication.

- Vehicle Information: Details such as make, model, year, and color of the vehicle are necessary for identification.

Legal Implications of Missing Information

Incomplete or inaccurate information on a Texas car insurance card can have significant legal ramifications. Driving without a valid insurance card or with incorrect information may result in fines, penalties, or suspension of driving privileges. This can be further complicated if there’s an accident or a traffic violation.

- Traffic Stops: Law enforcement officers may issue citations or impound the vehicle if the insurance card is missing or contains inaccuracies.

- Accidents: Accurate insurance information is critical during an accident to facilitate claim processing and avoid legal disputes.

- Court Proceedings: In court cases, the insurance card’s information is a key document for establishing proof of coverage.

Importance of Accuracy in Data Entry

Ensuring accuracy in data entry is paramount to avoid potential legal complications. Double-checking the information entered on the insurance card before submission is a crucial step. The accuracy of the data is essential for both the policyholder and the insurance company.

Data Types for Fields

The following table Artikels the expected data types for each field on the Texas car insurance card:

| Field | Data Type | Example |

|---|---|---|

| Policyholder Name(s) | Text | John Smith |

| Policy Number | Alphanumeric | 2023-ABC-123 |

| VIN | Alphanumeric | 1A2B3C4D5E6F7G8 |

| Insurance Company Name | Text | State Farm Insurance |

| Policy Effective Dates | Date | 01/01/2024 – 12/31/2024 |

| Coverage Limits | Numeric | 100,000 |

| Contact Information | Text, Phone Number, Address | 123-456-7890, 123 Main St, Anytown, TX 12345 |

| Vehicle Information | Text | 2023 Ford F-150, Red |

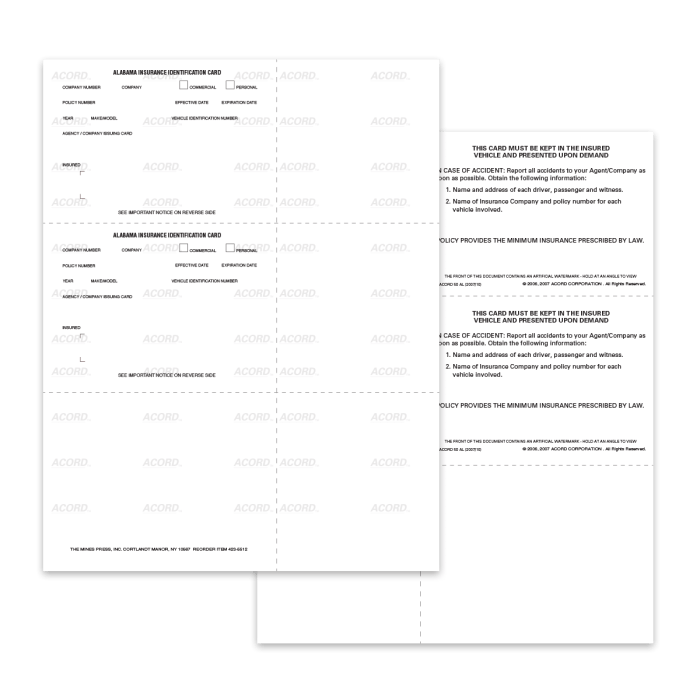

PDF Formatting Considerations

A well-formatted Texas car insurance card PDF is crucial for readability, accuracy, and compliance. Clear and concise formatting ensures policyholders can quickly access vital information, minimizing confusion and potential errors. This section delves into optimal PDF formatting practices for Texas car insurance cards.Effective PDF formatting significantly impacts the user experience and ensures the card’s usefulness. Poor formatting can lead to misinterpretations of policy details, making the card less reliable and potentially leading to compliance issues.

Optimal Font Choices and Sizes

Choosing appropriate fonts and sizes is paramount for readability. Fonts should be clear, easily legible, and avoid overly decorative styles. A standard, sans-serif font like Arial or Calibri is generally recommended for body text. Font sizes should be large enough to be easily read without straining the eyes, but not so large that the card becomes excessively bulky.

A size 12 point font is often a suitable choice for body text, with headings and important details using larger sizes (e.g., 14-16 point).

Finding the right Texas car insurance card template PDF is crucial for smooth DMV interactions. While you’re browsing for that, consider the beautiful wall decor options available at brewster home fashions wall decor to complement your new car insurance card. Ultimately, having a properly formatted Texas car insurance card template PDF is essential for hassle-free vehicle registration and driving.

Effective Layout and Spacing

Effective use of white space and consistent spacing is critical for readability. Avoid overcrowding the card with text or graphics. Use appropriate margins and line spacing to separate different sections of information. Grouping related information together in logically organized sections improves the clarity and comprehensiveness of the card. Clear visual separation of different data points (e.g., policyholder information, coverage details, contact information) is essential.

Color Usage and Contrast, Texas car insurance card template pdf

Color choice plays a vital role in enhancing readability and visual appeal. Ensure sufficient contrast between text and background colors. Using dark text on a light background or vice versa ensures optimal visibility. Use colors strategically to highlight important details or sections, but avoid overwhelming the card with excessive color. For example, a light gray background with dark blue text provides good contrast and readability.

Table Comparing PDF Layout Options

| Layout Option | Description | Pros | Cons |

|---|---|---|---|

| Single-Column | All text and data in a single column. | Simple and easy to implement. | Can become cluttered if the information is extensive. |

| Two-Column | Divides the card into two columns, allowing for better organization and layout of the information. | Improves readability and organization of content. | Can be less compact if not designed effectively. |

| Grid-Based | Utilizes a grid system for formatting data. | Highly organized and structured. | Requires careful design to ensure visual appeal and readability. |

| Sectioned | Divides the card into different sections based on the type of information. | Clear separation of information, enhances readability. | Requires a more complex design to maintain visual flow. |

Examples of Good and Bad Formatting

- Good Formatting: A well-formatted card uses clear headings, consistent font sizes, sufficient white space, and proper spacing between sections. Important information, such as policy details and contact numbers, is prominently displayed.

- Bad Formatting: A card with extremely small font sizes, overlapping text, or poor color choices negatively impacts readability and can make the information difficult to understand. Using overly decorative fonts or crammed layouts can lead to confusion and errors.

Importance of Readability and Clarity

Readability and clarity are paramount for any insurance card. A well-designed card should make it easy for policyholders to quickly locate the information they need. This reduces confusion, errors, and potential issues. Clear formatting and easily readable fonts enhance the card’s usability.

Legal and Regulatory Compliance

Texas law mandates specific requirements for automobile insurance cards. Adherence to these regulations is crucial for both insurers and policyholders to ensure legal validity and avoid penalties. Understanding these requirements safeguards the interests of all parties involved.Texas Department of Insurance (TDI) regulations govern the format, content, and issuance of insurance cards. Non-compliance can result in fines, penalties, and potential legal ramifications for both the insurance company and the policyholder.

Consequently, careful attention to detail is essential during the creation and distribution of these documents.

Legal Requirements for Texas Car Insurance Cards

Texas law demands that car insurance cards contain precise information, including the policyholder’s name, policy number, coverage details, and expiration date. Accurate representation of this data is essential for the card’s validity. Failure to include or misrepresent this information renders the card invalid and can lead to penalties.

Need a Texas car insurance card template PDF? It’s crucial for smooth travel, especially if you’re planning an extensive trip like a 10-day Vietnam tour itinerary. Finding a reliable template is key, but remember to verify the accuracy of the document before your trip, ensuring it meets all local requirements. For a detailed guide on planning a memorable 10-day Vietnam tour, check out this comprehensive itinerary: vietnam tour itinerary 10 days.

This will ensure your Texas car insurance card is valid and readily available throughout your journey.

State Regulations and Guidelines

The Texas Department of Insurance (TDI) provides comprehensive guidelines for the design and content of car insurance cards. These guidelines detail specific formatting requirements, font sizes, and acceptable information fields. Adhering to these regulations ensures that the insurance cards meet legal standards and promote transparency.

Consequences of Non-Compliance

Non-compliance with Texas car insurance card regulations can lead to significant consequences. The insurance company issuing the card could face fines or penalties, potentially impacting its operations. Additionally, policyholders who present invalid cards might encounter difficulties in proving their insurance status, leading to potential legal issues or financial penalties during traffic stops. The severity of penalties depends on the nature and extent of the non-compliance.

Summary of Key Legal Requirements

| Requirement | Description |

|---|---|

| Policyholder Information | Accurate name, address, and contact details of the policyholder. |

| Policy Number | Unique identifier of the insurance policy. |

| Coverage Details | Clearly defined coverage types (e.g., liability, collision, comprehensive). |

| Expiration Date | Date when the insurance coverage terminates. |

| Issuing Company Information | Name and contact details of the insurance company. |

| Physical Format | Compliance with the prescribed physical characteristics, such as font size, color, and paper type. |

Practical Application and Usage

The Texas car insurance card is more than just a piece of paper; it’s a crucial document that verifies your insurance coverage and protects you in various situations. Understanding its purpose and how to use it effectively is essential for navigating everyday driving and unexpected circumstances. Proper use of the card demonstrates compliance with Texas law and helps ensure a smooth interaction with authorities and other drivers.The Texas car insurance card acts as a readily accessible record of your vehicle’s insurance details.

This allows for quick verification of coverage when needed, avoiding potential delays or complications. It’s a fundamental component of responsible driving and helps you avoid penalties and legal issues.

Demonstrating Insurance Coverage

This section details the practical applications of the Texas car insurance card in various scenarios. A crucial role of the card is to readily demonstrate your insurance coverage to authorities, other drivers, and insurance adjusters. This verification ensures you are complying with Texas driving regulations.

- Accident Scene: At the scene of an accident, having your insurance card readily available is vital. It allows the involved parties and the police to quickly ascertain your insurance information and verify your compliance with state laws.

- Traffic Stops: When pulled over by law enforcement for a traffic violation or other reason, officers will request proof of insurance. Presenting your card swiftly demonstrates your compliance and avoids further delays.

- Insurance Claims: In case of an accident, the insurance card provides critical details for filing an insurance claim. It ensures your insurance company can locate your policy and process your claim efficiently.

Essential Situations Requiring the Card

The following table highlights scenarios where your Texas car insurance card is indispensable. The presence of the card ensures that you comply with legal requirements and navigate potentially complex situations smoothly.

| Situation | Importance |

|---|---|

| Traffic Stop | Demonstrates compliance with Texas traffic laws and avoids potential penalties. |

| Accident | Provides essential insurance details to involved parties and authorities, facilitating claim processing and legal proceedings. |

| Insurance Claim Filing | Allows insurance companies to quickly identify your policy and process your claim. |

| Vehicle Registration Renewal | May be required as part of the renewal process to verify insurance status. |

| Vehicle Transfers | Proof of insurance may be necessary during vehicle title transfers to ensure compliance with regulations. |

Generating a Template

Creating a Texas car insurance card template in PDF format involves careful planning and adherence to specific design guidelines. This template should clearly and concisely display all necessary information while remaining user-friendly and legally compliant. Accurate and consistent formatting is crucial for ensuring the card’s reliability and preventing any misinterpretations.

Template Structure

The structure of the template is fundamental to its clarity and usability. A well-organized template guides users through the necessary information. A clear, logical layout ensures that the card’s information is readily accessible and understandable.

- Header Section: This section should prominently display the words “Texas Car Insurance Card” or similar wording. This section should also include a designated space for the insurer’s logo.

- Policyholder Information: A dedicated section should contain the policyholder’s name, address, phone number, and driver’s license information. Consider using a clear and concise format for this data to ensure accuracy.

- Vehicle Information: The template should also include fields for the vehicle’s year, make, model, and vehicle identification number (VIN). Ensuring accuracy in this section is vital for identification purposes.

- Insurance Information: This section will contain the policy details, such as the policy number, effective dates, and coverage limits. A standardized format is recommended to maintain clarity and reduce the possibility of errors.

- Contact Information: A contact section should be included for the insurance company, with a phone number and website address.

Design Elements

The design of the template should be visually appealing and easy to read. Using consistent fonts and colors will help to ensure a professional and recognizable look. Employing appropriate spacing and margins will make the template visually clear and readable.

- Font Selection: A clear, legible font such as Arial, Calibri, or Times New Roman should be selected. A font size that is easy to read is recommended, ensuring readability even for those with visual impairments.

- Color Scheme: A simple, professional color scheme should be chosen, avoiding overly bright or distracting colors. Consider using a color scheme that complements the insurance company’s branding.

- Layout and Spacing: Consistent spacing between sections and elements will improve readability and visual appeal. Using white space effectively will further enhance the card’s clarity and legibility.

Step-by-Step Guide

The following table provides a step-by-step guide for creating a Texas car insurance card template in PDF format.

| Step | Action |

|---|---|

| 1 | Design the layout: Plan the arrangement of elements, ensuring sufficient space for each section of information. |

| 2 | Choose fonts and colors: Select fonts and colors that are legible and visually appealing, maintaining a consistent style with the insurance company’s brand. |

| 3 | Add text fields: Create clearly labeled text fields for each required piece of information (policyholder, vehicle, and insurance details). |

| 4 | Insert images: Include the insurance company’s logo, if desired. |

| 5 | Finalize formatting: Ensure that all text and images are appropriately sized and aligned. Check for accuracy in all data fields. |

| 6 | Save as PDF: Save the document in PDF format for optimal compatibility and preservation of formatting. |

Template Accessibility and Download

Ensuring easy access to the Texas car insurance card template is crucial for its effective use. This involves not only providing a readily downloadable file but also considering the needs of various users and their access methods. A user-friendly format is essential to facilitate smooth retrieval and use.Streamlining the download process is vital for efficient template access. This includes optimizing file size, providing clear download instructions, and ensuring the template is available in multiple formats where possible.

Users should not be burdened by complex download procedures.

Download Methods

Optimizing the download process involves a variety of considerations. Different users may have varying preferences for download methods, so a variety of options should be offered. Providing options for direct download links, embedded download buttons, or even facilitating download through a secure server are examples of methods that will enhance the user experience. Choosing the best option depends on the context and technical considerations.

File Format Considerations

Different file formats cater to various needs and situations. Providing the template in multiple formats, such as PDF, Word, and potentially even image formats, will increase usability and compatibility. Users should be given the option to choose the format that best suits their needs and software.

Template Accessibility Considerations

Template accessibility goes beyond just the download process. Ensuring compatibility with assistive technologies is essential for users with disabilities. Utilizing clear and concise language, and providing alternative text descriptions for images, are crucial for accessibility.

User-Friendly Format Suggestions

A user-friendly format for the downloadable template is paramount for effective usage. The template should be easy to navigate, and all necessary information should be clearly presented. Consider these suggestions for a user-friendly format:

| Aspect | Suggestion |

|---|---|

| File Size | Optimize file size to minimize download time. |

| File Type | Offer multiple file formats (PDF, Word, etc.) for compatibility. |

| Instructions | Include clear and concise download instructions. |

| Navigation | Ensure the template is easy to navigate, with clear labeling of sections. |

| Visual Design | Use clear fonts, colors, and spacing to enhance readability. |

| Accessibility | Ensure compatibility with assistive technologies (screen readers). |

| Metadata | Include metadata (title, author, date) to enhance searchability. |

Final Thoughts: Texas Car Insurance Card Template Pdf

In conclusion, a well-formatted Texas car insurance card template pdf is essential for maintaining legal compliance and facilitating seamless interactions with authorities. This guide has provided a thorough overview of the required information, variations, and formatting nuances, equipping you with the knowledge needed to navigate the process effectively. By understanding the legal implications and practical applications, you can ensure your insurance card meets all requirements and remains a valuable resource.

Questions and Answers

What are the penalties for not having a valid Texas car insurance card?

Failure to carry a valid Texas car insurance card can result in fines and potential legal repercussions, depending on the specific situation and local regulations.

How often should I update my Texas car insurance card?

Update your card whenever your insurance details change, such as policy renewal or address updates.

Are there different formats for commercial vehicles?

Yes, commercial vehicle insurance cards might have additional sections and requirements compared to personal vehicles.

Can I create this template myself if I’m not a designer?

Yes, readily available templates and online tools can assist in creating a suitable template, even without design expertise.