Combined life insurance claim forms streamline the process for beneficiaries, consolidating multiple policies into one document. Navigating these forms can feel daunting, but this guide breaks down the complexities, providing clear instructions and examples to ensure a smooth claim process. From understanding the various policy types to gathering necessary documents, this comprehensive overview addresses every step of filing a combined life insurance claim.

This guide delves into the intricacies of combined life insurance claim forms, highlighting the importance of accuracy, supporting documentation, and a clear understanding of the claim process. Visual aids like tables will help you grasp the essential information and potential challenges.

Understanding Combined Life Insurance Claim Forms

Combined life insurance claim forms streamline the process for beneficiaries by consolidating various requirements into a single document. This simplifies the claim submission and reduces the administrative burden on the claimant. These forms are designed to efficiently collect all necessary information for processing life insurance benefits, minimizing delays and maximizing the timely payment of claims.Combined life insurance claim forms are designed to collect the essential information for processing life insurance benefits quickly and accurately.

They consolidate various requirements, including policy details, beneficiary information, and supporting documentation, into a single document. This approach simplifies the claim process for beneficiaries and streamlines the administrative burden on insurance companies.

Types of Life Insurance Policies Using Combined Forms

These forms are commonly used across various types of life insurance policies. Term life insurance, whole life insurance, universal life insurance, and variable life insurance can all utilize combined claim forms. The specific requirements may vary slightly based on the type of policy, but the core information needed for the claim process remains consistent. The forms are designed to be flexible enough to accommodate different policy structures while remaining comprehensive in their information gathering.

Situations Requiring Combined Claim Forms

Combined claim forms are crucial in situations where a claim needs to be processed efficiently and completely. For example, when the death is unexpected, the process needs to be swift and the form is designed to facilitate that. A death due to an accident, natural disaster, or sudden illness often necessitates a combined form to ensure the collection of necessary information in a timely manner.

Another example includes policies with complex beneficiary designations, requiring detailed information for proper identification and allocation of funds.

Common Sections of Combined Claim Forms

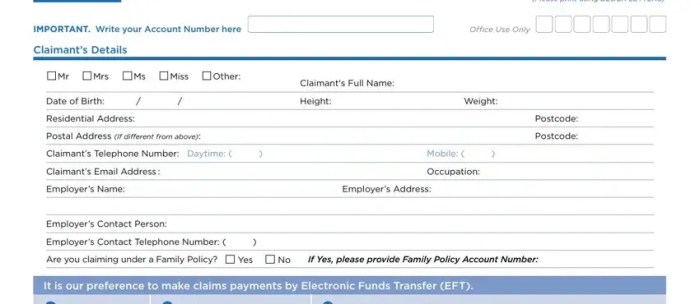

The structure of these forms is designed to gather all the essential information systematically. A typical form has distinct sections to ensure comprehensive coverage of all necessary data. These sections include, but are not limited to, policy details, death certificate information, beneficiary information, and supporting documentation.

Table of Typical Sections and Information Required

| Section | Information Required |

|---|---|

| Policy Details | Policy number, policyholder name, date of policy issue, coverage amount, and premium payment history. |

| Death Certificate Information | Full name of the deceased, date and place of death, cause of death, date of birth, and the issuing authority’s official seal and signature. |

| Beneficiary Information | Full names of beneficiaries, relationship to the deceased, percentage or dollar amount of the benefit allocation, and contact information. Supporting documentation for named beneficiaries, like power of attorney, may be required. |

| Supporting Documentation | Copies of relevant documents, such as medical records, death certificates, and other documentation related to the cause of death, if applicable. |

| Claimant Information | Full name of the claimant, relationship to the deceased, contact information, and any supporting documentation proving their claim to be the legal representative of the deceased or the beneficiary. |

Completing Combined Life Insurance Claim Forms Accurately

Accurate completion of combined life insurance claim forms is crucial for a smooth and timely claim processing. Inaccurate information or omissions can significantly delay the claim settlement or even lead to rejection. Understanding the specific requirements and procedures for completing these forms is vital for beneficiaries to ensure a positive outcome.Comprehensive and precise information is essential for insurance companies to verify the claim and make a prompt payment.

Errors or omissions can introduce complexities that impede the process, potentially leading to disputes or denial of the claim. This section will Artikel the importance of accuracy, potential consequences of errors, and provide a step-by-step guide for filling out the forms, along with details on verification procedures and considerations for different claim types.

Importance of Accuracy

Accurate completion of the forms is paramount. Incorrect or incomplete information can delay or prevent the claim from being processed. This could result in financial hardship for beneficiaries who depend on the insurance payout. Carefully scrutinizing each section is critical to avoid errors.

Potential Consequences of Errors or Omissions

Errors or omissions in the forms can have serious consequences. Delayed processing, claim rejection, or even the need for further documentation can occur. This can be especially problematic for beneficiaries relying on the funds for immediate needs. The insurance company may request additional information, leading to further delays.

Step-by-Step Procedure for Filling Out the Forms

A structured approach to completing the forms can prevent errors. Begin by carefully reviewing the entire form. Ensure all required information is gathered. Use clear and legible handwriting or type all responses. Provide accurate dates, names, and other identifying details.

Be thorough in detailing the circumstances surrounding the death. If possible, consult the insurance policy for specific instructions or requirements. Attach any necessary supporting documents.

Combined life insurance claim forms can be a bit of a headache, but they’re often necessary. Finding suitable housing is important, too, especially if you’re navigating a claim. For example, if you’re moving out of your current residence after a life event, you might need to find a new place like the landing apartments san angelo , which could be a great option.

Ultimately, however, properly completing these forms is key to getting your claim processed efficiently.

Verification Processes for Different Sections

Different sections of the forms require varying verification methods. Personal details, such as names and dates of birth, are typically verified against government-issued identification documents. Details regarding the cause of death are verified against medical records, death certificates, and police reports, as applicable. Proof of policy ownership and beneficiary designations must be confirmed.

Completion Process for Different Claim Types

The completion process can vary based on the type of claim. For accidental death claims, detailed accident reports and supporting evidence of the incident are often required. For natural causes, death certificates and medical records are essential. The specific requirements will be Artikeld in the form instructions. Each type of claim will have unique documentation needs.

Comparison of Completion Process for Different Claim Types

| Claim Type | Essential Documents | Verification Process |

|---|---|---|

| Accidental Death | Accident report, witness statements, medical records, police report | Verification of accident details, authenticity of documents |

| Natural Causes | Death certificate, medical records, physician’s statement | Verification of cause of death, accuracy of medical records |

Common Mistakes and Their Potential Impact

| Common Mistake | Potential Impact |

|---|---|

| Incorrect beneficiary information | Claim payout to the wrong individual or entity |

| Missing supporting documents | Claim denial or delay due to lack of evidence |

| Inaccurate dates or details | Errors in processing, claim rejection |

| Incomplete medical information (natural causes) | Difficulty in verifying the cause of death |

| Incorrect policy number | Inability to identify the correct policy |

Supporting Documentation Required

A combined life insurance claim involves a streamlined process for handling multiple claims, often for life insurance and other related benefits. This streamlined approach requires comprehensive documentation to verify the claim’s validity and ensure accurate payouts. The required supporting documents vary depending on the specific policies and circumstances, but generally encompass proof of death, beneficiary information, and policy details.Thorough documentation is crucial for a successful claim.

Incomplete or inaccurate supporting documents can delay or even prevent the claim from being processed. This section details the necessary supporting documentation for a combined life insurance claim, outlining the importance of each document, acceptable forms of proof, and the procedure for attaching them correctly. Accurate and timely submission of these documents is vital for efficient claim processing.

Death Certificate

The death certificate is the primary document confirming the death of the insured. It serves as the official record of the cause and manner of death. The certificate’s importance lies in establishing the fact of death and providing critical details for the claim.Acceptable forms of proof include the original death certificate or a certified copy issued by the appropriate authorities.

The death certificate must contain the insured’s full name, date of birth, date of death, cause of death, and the issuing authority’s signature and seal.

Proof of Beneficiary

This document identifies the individuals or entities entitled to receive the life insurance benefits. It is essential to demonstrate the beneficiary’s right to receive the proceeds.Acceptable forms of proof include the original policy documents with the beneficiary designation, a copy of the policy showing the beneficiary’s name and relationship to the insured, or a legally executed change of beneficiary form, if applicable.

The form must be properly signed and dated, and, if a change, filed with the insurance company.

Policy Documents

The policy documents are essential for verifying the details of the insurance contract. They contain crucial information regarding the coverage amount, premium payments, and the terms of the policy.Acceptable forms of proof include the original policy document, a copy of the policy showing the coverage amount, and any amendments or endorsements to the policy. This provides the insurance company with the necessary information to assess the validity and terms of the insurance contract.

Other Supporting Documents

Other documents may be required depending on the circumstances of the claim. These documents could include medical records, if related to the cause of death, or financial statements if the claim involves estate issues. Their importance lies in providing further evidence or context to the claim.

List of Common Documents and Required Formats

- Death Certificate: Original or certified copy, issued by the appropriate authorities.

- Beneficiary Designation: Copy of the policy with beneficiary information, or a legally executed change of beneficiary form, if applicable.

- Policy Documents: Original or certified copy of the policy, including any amendments or endorsements.

- Medical Records (if applicable): Copies of relevant medical records, certified by a healthcare provider, if needed to support the cause of death.

- Financial Statements (if applicable): Copies of relevant financial documents, if the claim involves estate issues or other financial considerations.

Attaching Supporting Documents, Combined life insurance claim forms

Proper attachment of documents is critical. Ensure each document is clearly labeled, and a list of attached documents is included with the claim form. Documents should be stapled or clipped together, with each page clearly numbered for easy reference. This will help expedite the claim processing and avoid any potential errors. Properly numbered and organized documents enhance the claim’s efficiency and accuracy.

Table of Documents Needed

| Document | Purpose |

|---|---|

| Death Certificate | Proof of death, cause, and manner of death |

| Beneficiary Designation | Identification of rightful beneficiaries |

| Policy Documents | Verification of policy terms, coverage, and premium payments |

| Medical Records (if applicable) | Supporting evidence regarding the cause of death |

| Financial Statements (if applicable) | Supporting information for estate issues or financial considerations |

Navigating the Claim Process

Filing a life insurance claim can be a complex process, often fraught with emotional distress and administrative hurdles. Understanding the typical steps, communication channels, and the role of the insurance company is crucial for a smooth and efficient claim resolution. Navigating these steps requires patience, meticulous record-keeping, and adherence to the insurance company’s specific procedures.The claim process involves a series of steps, from initial notification to final settlement.

Effective communication and accurate documentation are key to minimizing delays and maximizing the chances of a successful claim. The insurance company, while upholding its contractual obligations, has a specific role to play in the process. Claimants must understand their rights and responsibilities, as well as the company’s procedures, to ensure a favorable outcome.

Typical Steps Involved in Filing a Claim

The typical claim process involves several distinct stages, each with specific requirements. This structured approach aims to ensure the claim is processed fairly and efficiently, while minimizing the risk of errors or omissions.

- Initial Notification: The claimant must immediately notify the insurance company of the death of the insured. This initial notification usually involves contacting the company directly, either by phone or mail, and providing basic information such as the insured’s name, policy number, and date of death. Examples of this notification might include a phone call to the insurance company or an official letter detailing the situation.

- Claim Form Completion: The insurance company will provide or request a claim form, which needs to be completed accurately and thoroughly. This form typically requires details about the insured, the beneficiary, and the circumstances surrounding the death. It is crucial to provide all requested information accurately and promptly to avoid delays.

- Supporting Documentation Submission: The insurance company will require supporting documents to validate the claim. This often includes the death certificate, proof of beneficiary designation, and any other documents deemed necessary by the company. The claimant should ensure all documents are complete and accurate. The claimant should also verify the required documentation with the insurance company in advance to avoid unnecessary delays.

- Claim Review and Evaluation: The insurance company will review the submitted claim form and supporting documents to determine the validity of the claim. This stage may involve an investigation or further inquiries to verify the claim’s legitimacy. This process might involve contacting the medical examiner or investigating the cause of death if needed.

- Settlement: If the claim is approved, the insurance company will proceed with the settlement process. This typically involves issuing a payment to the beneficiary, following the terms of the policy and beneficiary designations. The amount paid is often determined by the policy’s terms and conditions.

Communication Channels Available to the Claimant

Effective communication is vital during the claim process. The claimant should maintain open communication with the insurance company.

Combined life insurance claim forms can be a bit of a hassle, but they can streamline the process. Navigating the forms can be easier if you have a good understanding of the procedures. For example, if you’re looking for parking near State Farm Stadium, you might find yourself needing to locate an orange parking lot, like the one at orange parking lot state farm stadium.

Ultimately, understanding the specifics of these claim forms will help ensure a smoother claim process.

- Phone: Many insurance companies provide phone numbers for claim inquiries. Using this channel allows for direct questions and answers, which can be useful for clarifications and urgent matters.

- Email: Email communication offers a written record of correspondence, which can be useful for tracking progress and addressing specific concerns.

- Mail: Formal communication, such as sending official documents via mail, provides a physical record of the correspondence.

- Online Portals: Some insurance companies have online portals for managing claims, providing access to claim status updates and supporting documents.

Role of the Insurance Company in the Claim Process

The insurance company plays a crucial role in the claim process, ensuring a fair and efficient resolution.

- Reviewing Claims: The insurance company is responsible for reviewing the submitted claim form and supporting documents to determine the claim’s validity.

- Investigating Claims: In some cases, the insurance company might need to conduct further investigations to verify the claim details.

- Processing Payments: Once the claim is approved, the insurance company handles the payment to the beneficiary according to the policy’s terms and the beneficiary designation.

- Responding to Inquiries: The insurance company should respond to claimant inquiries in a timely and professional manner.

Following Up on Claim Status

Regularly checking the claim status is essential for keeping track of the claim’s progress.

- Contacting the Insurance Company: The claimant should regularly contact the insurance company to inquire about the status of their claim.

- Checking Online Portals: If the insurance company offers an online portal, regularly checking it for updates can provide valuable insights into the claim’s progress.

Potential Delays or Complications

Delays or complications in the claim process can occur due to various factors.

- Incomplete Documentation: Missing or inaccurate supporting documents can significantly delay the claim process.

- Verification Issues: Discrepancies in the provided information or verification issues with supporting documents may lead to delays.

- Complex Circumstances: Claims involving complex circumstances, such as unusual causes of death or contested beneficiaries, may take longer to process.

Stages of the Claim Process and Timelines

The table below provides an estimated timeline for each stage of the claim process. Actual timelines may vary based on the specific circumstances of the claim.

| Stage | Description | Estimated Timeline |

|---|---|---|

| Initial Notification | Contacting the insurance company and providing basic information | Within 24-48 hours |

| Claim Form Completion & Submission | Completing and submitting the claim form and required documents | Within 5-7 days |

| Claim Review & Investigation | Reviewing documents, and potentially investigating further | 10-30 days |

| Settlement | Issuing payment to the beneficiary | 7-30 days (after approval) |

Addressing Common Challenges

Filing a combined life insurance claim can present various hurdles. Understanding these challenges and employing appropriate strategies significantly increases the likelihood of a smooth and successful claim process. From navigating bureaucratic procedures to dealing with potentially contentious insurance company representatives, a proactive approach is essential.

Common Challenges in Filing a Claim

The insurance claim process, while generally straightforward, can encounter obstacles. These obstacles often stem from procedural complexities, misunderstandings, or disputes regarding policy coverage. A thorough understanding of these common challenges is crucial for successful claim resolution.

- Policy Ambiguity: Policy wording can be ambiguous or unclear, leading to disputes over coverage. A precise understanding of the policy’s terms and conditions is vital. Carefully review the policy document and seek clarification from the insurance provider if any uncertainties exist.

- Supporting Documentation Issues: Incomplete or incorrect supporting documentation can delay or deny a claim. Ensure all required documents, such as death certificates, medical records, and financial statements, are accurate, complete, and properly submitted.

- Communication Barriers: Misunderstandings or ineffective communication between the claimant and the insurance company can complicate the process. Maintaining clear and professional communication throughout the claim process is essential.

- Insurance Company Tactics: Some insurance companies may employ tactics to delay or deny claims. Understanding these tactics and responding appropriately is key to navigating these potential issues.

Resolving Challenges

Addressing the identified challenges requires a proactive and strategic approach. Employing these methods helps minimize potential complications and expedite the claim process.

- Thorough Policy Review: A comprehensive review of the policy’s terms and conditions is the first step in ensuring the claim aligns with the policy’s coverage. Seeking clarification on ambiguous wording from the insurance company is advisable.

- Accurate Documentation: Ensuring the accuracy and completeness of supporting documentation is critical. Reviewing all documents for completeness and accuracy, and organizing them logically, significantly reduces potential delays.

- Effective Communication: Maintain clear and professional communication with the insurance company. Keep detailed records of all communications, including dates, times, and contents of conversations. If necessary, seek assistance from a claims advocate or legal professional.

- Dispute Resolution Strategies: If the insurance company presents a denial or delays the process, employ appropriate dispute resolution strategies. This might involve appealing the denial, negotiating, or, in some cases, seeking legal intervention.

Dealing with Insurance Representatives

Insurance representatives play a critical role in the claim process. Effective interaction with these representatives can significantly impact the claim’s outcome.

- Professionalism: Maintaining a professional and respectful demeanor, even in challenging situations, is essential. Focus on presenting the claim’s merits logically and factually.

- Documentation: Be prepared to provide complete and accurate supporting documentation. This strengthens the claim’s validity and helps the representative understand the circumstances.

- Seeking Clarification: If any aspect of the claim process or the representative’s response is unclear, seek clarification immediately. Do not hesitate to ask questions.

Role of Legal Counsel in Complex Claims

Legal counsel can be invaluable in complex or contentious life insurance claims.

- Expertise: Legal counsel possesses the expertise to navigate complex legal procedures and insurance policies. This expertise is critical in situations where disputes arise over policy interpretations or coverage.

- Negotiation: Legal counsel can effectively negotiate with the insurance company to achieve a favorable outcome. Their knowledge of legal precedents can be instrumental in these negotiations.

- Litigation: In cases where negotiation fails, legal counsel can initiate litigation to pursue the claim’s merits in court. This is crucial when the insurance company’s actions are deemed inappropriate or unjust.

Examples of Situations Requiring Legal Intervention

Legal intervention may be necessary in situations involving significant policy disputes, substantial financial losses, or if the insurance company employs tactics deemed inappropriate or unfair.

- Complex Policy Language: If the policy’s language is exceptionally complex and ambiguous, leading to a dispute about coverage.

- Denial of a Claim Based on Inconsequential Details: If the insurance company denies a claim based on minor or inconsequential details.

- Unreasonable Delay Tactics: If the insurance company employs unreasonable delay tactics to impede the claim process.

Potential Challenges and Suggested Solutions

| Potential Challenge | Suggested Solution |

|---|---|

| Policy ambiguity | Thorough policy review; seek clarification from the insurance company. |

| Incomplete documentation | Ensure all required documents are accurate and complete; obtain necessary supporting materials. |

| Communication barriers | Maintain clear and professional communication; document all interactions. |

| Insurance company tactics | Understand potential tactics; document all interactions; seek legal counsel if necessary. |

Illustrative Examples

Illustrative examples of successful and complex life insurance claims provide valuable insights into the claim process. These case studies highlight the importance of accurate claim completion, proper documentation, and timely communication. They also demonstrate the potential challenges and resolutions within the insurance claims framework.Understanding the nuances of successful and complicated claims is crucial for both policyholders and insurance providers.

It aids in the efficient handling of claims, minimizes delays, and promotes transparency.

Successful Combined Life Insurance Claim

A policyholder, Mr. Smith, passed away, triggering a combined life insurance claim involving a term life insurance policy and a whole life insurance policy. Both policies were held by the same insurer. Mr. Smith’s death certificate, the claim form meticulously completed by his designated beneficiary, and supporting documentation, including bank statements, pay stubs, and tax returns, were all submitted within the specified timeframe.

The insurance company thoroughly reviewed the submitted documents, confirming the beneficiary’s identity and the validity of the claim. The process was streamlined due to the completeness and accuracy of the supporting documentation. The claim was processed swiftly, and the beneficiary received the combined payout within the agreed timeframe.

- Supporting Documents: Death certificate, claim form, beneficiary designation, bank statements, pay stubs, tax returns.

- Steps Involved: Complete claim form, gather supporting documents, submit documents to insurer, and await claim processing.

- Outcome: Successful and timely claim processing; beneficiary received the full combined payout.

“A well-documented claim, submitted within the required timeframe, significantly contributes to a successful and efficient insurance claim process.”

Complicated Combined Life Insurance Claim

Mrs. Jones’s death necessitated a combined claim on a variable universal life insurance policy and a supplemental life insurance policy. The claim process faced complications. First, the claim form was incomplete, leading to a request for additional information. Secondly, the supporting documents were not all readily available.

The beneficiary was also unsure about some of the policy details. This led to delays in processing.

- Supporting Documents: Death certificate, incomplete claim form, partial policy documents, beneficiary’s affidavit, bank statements.

- Steps Involved: Identifying the missing information, providing the necessary documentation, and actively communicating with the insurer throughout the process.

- Outcome: The claim was resolved after the missing documentation was provided, and the beneficiary received a payout, although delayed due to the initial complications. Mrs. Jones’s family had to provide clarification on the policies and missing documentation.

“Even with complications, a combined claim can be resolved through diligent communication and cooperation between the beneficiary and the insurance company.”

Concluding Remarks

In conclusion, filing a combined life insurance claim requires careful attention to detail and a thorough understanding of the process. By following the steps Artikeld in this guide, beneficiaries can confidently navigate the complexities and ensure a smooth and efficient claim process. Remember to prioritize accuracy, gather all necessary documentation, and communicate effectively with the insurance company. This guide serves as a valuable resource, empowering you with the knowledge needed to successfully navigate this crucial process.

Question Bank

What are the potential consequences of errors or omissions on a combined life insurance claim form?

Errors or omissions can delay or even deny the claim. It’s crucial to ensure all information is accurate and complete.

What supporting documents are typically required for a combined life insurance claim?

Common documents include the death certificate, proof of beneficiary designation, and policy documents. The specific requirements vary by insurance company.

How can I resolve common challenges encountered during a combined life insurance claim?

Effective communication with the insurance company and seeking clarification on any unclear points is key. For complex claims, consulting with legal counsel can be beneficial.

What are the typical steps involved in filing a combined life insurance claim?

Generally, this involves completing the claim form, gathering supporting documents, submitting the claim, and following up on the status.