Computer software designed for monitoring insurance claims is revolutionizing how insurers handle claims. From streamlining the claim process to improving efficiency and accuracy, this software offers a comprehensive solution for managing various types of insurance claims, such as auto, health, and property. It provides insurers with valuable insights into claim trends, payouts, and resolution times, enabling data-driven decisions and ultimately, better customer service.

This software goes beyond basic tracking. It often integrates with existing systems like accounting software and CRM platforms, creating a seamless workflow. Features like automated alerts and dashboards keep stakeholders informed in real-time, ensuring quick resolution and reducing administrative burdens. Let’s delve into the details of this powerful tool.

Overview of Insurance Claim Monitoring Software

Yo, peeps! This software is like, totally crucial for insurance companies. It’s all about keeping tabs on claims, from start to finish. Imagine a super-organized system that makes handling claims way smoother and faster. That’s what this software does!This software is a digital tool designed specifically to oversee and manage the entire insurance claim lifecycle. It’s basically a central hub for tracking everything from the initial report to the final payment.

It’s built to streamline the process, minimize errors, and keep everyone on the same page.

Definition of Claim Monitoring Software

Insurance claim monitoring software is a digital system that helps insurance companies track, manage, and process insurance claims efficiently. It collects, organizes, and analyzes data related to claims, from initial reporting to final settlement. Think of it as a super-powered spreadsheet for insurance claims.

Core Functionalities

This software has a bunch of key functionalities. It can automate tasks, like sending reminders and notifications. It can also store and manage all claim-related documents, ensuring everything’s easily accessible. Plus, it provides real-time updates on claim status, helping everyone stay in the loop. Crucially, it helps identify potential fraud or errors early on.

This means fewer headaches and faster resolutions.

Sophisticated computer software designed for monitoring insurance claims can streamline the entire process, identifying potential fraud and ensuring accurate payouts. This is crucial, especially when considering properties like those available in the sought-after Three Hills area, with its range of houses for sale three hills. The software helps maintain transparency and efficiency, ultimately benefiting all stakeholders involved in the insurance claim process.

Types of Claims Tracked

This software can handle a wide variety of claims, including auto accidents, health issues, and property damage. It can track everything from the details of the accident to the amount of compensation paid out. Basically, any claim that involves insurance is fair game for this tech.

Key Benefits for Insurance Companies

Using this software brings a ton of advantages. It reduces claim processing time, which saves a lot of time and money. It also improves accuracy and reduces errors, leading to more satisfied customers. Moreover, it enhances transparency and accountability, which is important for maintaining trust with clients. Finally, it helps in better fraud detection, which is a big plus for insurance companies.

- Reduced Claim Processing Time: Faster processing means happier customers and less work for everyone involved. This is huge for boosting efficiency.

- Improved Accuracy and Reduced Errors: Fewer mistakes lead to better outcomes for everyone involved. This helps build trust with customers.

- Enhanced Transparency and Accountability: Clearer processes build trust and make sure everyone is on the same page.

- Better Fraud Detection: Identifying fraudulent claims early on saves companies a ton of money.

Comparison of Claim Monitoring Software Solutions

This table compares a few different claim monitoring software solutions. It shows the features and pricing, so you can choose the best fit for your needs.

| Name | Features | Pricing |

|---|---|---|

| ClaimTrack Pro | Automated claim routing, document management, real-time updates, fraud detection | Starts at $5,000 per month |

| InsurView | Comprehensive claim tracking, reporting, analytics, customizable dashboards | Starts at $8,000 per month |

| ClaimMaster | Intuitive interface, robust reporting tools, mobile access, 24/7 support | Starts at $10,000 per month |

Features and Capabilities

Yo, this software is totally fire for keeping tabs on insurance claims. It’s like, totally clutch for keeping everything organized and on track. It’s not just some basic spreadsheet; this thing is next-level.This section breaks down the sick features, from the data it collects to the rad reporting tools and how it integrates with other systems. It’s all about making claim processing smoother than a buttered noodle.

Data Collection and Management

This software collects a ton of crucial data, like policy details, claim amounts, dates, and statuses. It’s super organized, so you can easily find what you need. Think of it as a digital filing cabinet, but way more advanced. It’s basically a total game-changer for efficiency.

Reporting Capabilities

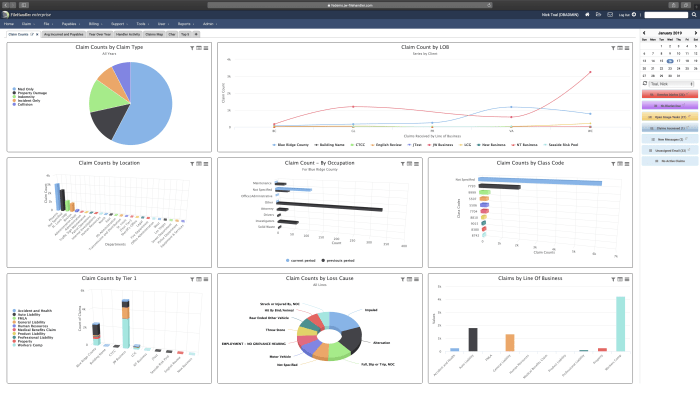

This software’s reporting tools are totally insane. You can generate reports on claim trends, payouts, and resolution times. This lets you see patterns and figure out where you can optimize your processes, saving major time and money. It’s like having a crystal ball for claim data.

Integration Possibilities

Integrating with other systems is a major plus. You can connect it to accounting software and CRM systems, making everything flow seamlessly. Imagine your whole insurance operation being one super-smooth machine! It’s like, super-productive and way less stressful.

Tracking insurance claims with specialized software is crucial for efficiency. Imagine the meticulous organization required, a stark contrast to the cozy, nostalgic charm of an old fashioned Christmas DVD, like an old fashioned Christmas DVD. Ultimately, robust software for monitoring insurance claims remains vital for a streamlined process.

Claim Management and Tracking

The software provides several ways to manage and track claims. Dashboards provide an at-a-glance view of key metrics. Workflow tools help streamline the claim process, keeping everything moving along smoothly. Automated alerts will keep you in the loop, so you never miss a thing. It’s like having a personal assistant for claim processing.

Automation of Tasks

This software automates many tasks related to claim processing. Think of things like data entry and generating basic reports. This frees up your team to focus on more important tasks, making them way more productive. It’s like having a robot army handling the mundane stuff.

Reporting Options

| Report Type | Data Included | Output Format |

|---|---|---|

| Claim Trend Report | Number of claims, claim amounts, claim types, claim statuses over a specific period. | Interactive charts and graphs |

| Claim Payout Report | Details of each claim payout, including the amount paid, policyholder details, and date of payment. | Spreadsheet (Excel) or PDF |

| Claim Resolution Time Report | Average time taken to resolve claims for different claim types or time periods. | Spreadsheet (Excel), charts, or graphs |

| Policy Summary Report | Policy details, claim history, and payment information for specific policies. | Spreadsheet (Excel) or PDF |

This table shows some of the reporting options available in the software. It’s super helpful for analyzing claim data and identifying areas for improvement.

User Interface and Experience

Yo, this is the lowdown on how our claim monitoring software is gonna be super user-friendly. We’re aiming for a design that’s not only easy to navigate but also totally visual, so you can quickly see what’s up with each claim. Think sleek, intuitive, and totally bomb.

User Roles and Permissions

Different peeps have different access levels to the system. This is crucial for security and keeping things organized. For example, adjusters have full access to claim details and can update statuses. Claims reps have read-only access, which prevents them from messing with things they shouldn’t. Admins have complete control, allowing them to manage users and adjust permissions.

This way, only the right people can do the right things, preventing any mix-ups or security breaches.

Claim Status Updates

The software displays claim status updates in a super clear way. Think progress bars for claims in processing, alerts for urgent claims, and real-time updates for everything. Visual cues like color-coding (green for approved, red for denied) are used for instant understanding. It’s like having a visual timeline of the claim’s journey, making it totally crystal clear where things are at.

Comparison of Different Claim Monitoring Software Interfaces

Different claim monitoring software platforms have their own styles. Some are super cluttered, making it hard to find what you need. Others are too basic, missing key features. Our software is designed to be a sweet spot, offering a balance of simplicity and functionality. We looked at what’s out there and learned from the best (and worst) examples.

We’re trying to make something that’s not just usable but also enjoyable to use.

User-Friendly Dashboard Example, Computer software designed for monitoring insurance claims

Imagine a dashboard with big, clear graphs and charts showing claim trends. It could highlight things like average claim processing time, claim amounts, and claim types. You can filter by date ranges, adjuster, or any other criteria. You can even drill down into specific claims for more detail. It’s like having all the data you need right there, ready to be analyzed in a snap.

Key User Interface Elements and Functionality

- Claim Number Input Field: Allows users to search for specific claims by entering the claim number. This is a super-important element for quickly finding claims. No more sifting through endless lists!

- Status Indicators: Visually represent the current status of a claim, like “Pending,” “In Progress,” or “Closed.” This helps users understand the claim’s progress at a glance. Think of it like a traffic light, but for claims!

- Filtering Options: Enable users to narrow down the displayed claims by date range, claim type, or adjuster. This feature helps target specific information without having to scroll through everything.

- Claim Details Panel: Provides a comprehensive view of a specific claim, including details like the insured’s information, the damages, and supporting documents. This is crucial for adjusters to make well-informed decisions.

- Action Buttons: Offer options like updating the claim status, adding documents, or generating reports. This makes managing claims a breeze.

Integration and Data Management

Yo, this software is totally fire for managing insurance claims. Legit, smooth data flow is key to keeping everything straight and preventing major headaches. We’re talkin’ seamless integration with existing systems, top-notch security, and a super-organized way to handle all the info. It’s like having a digital superhero for your claims team.This section breaks down how our claim monitoring software integrates with other systems, manages data, and keeps everything secure.

We’re talkin’ data validation, different data sources, and ensuring compliance, all while keeping things super user-friendly. Basically, we’re making insurance claims easier than ever before.

Data Security and Compliance

This software is totally built with security in mind. We’re talkin’ encryption, access controls, and all that good stuff to protect sensitive info. It’s totally essential to maintain compliance with industry regulations, like HIPAA and GDPR. This is crucial to avoid major legal issues and keep everyone’s data safe. Plus, we’re totally keeping up with the latest security standards.

Data Sources

This software integrates with a bunch of different data sources. It can grab info from your existing CRM, your billing system, and even third-party providers. This ensures that all the important details are in one place, making it easier to track claims and get a full picture of what’s happening. Imagine having all your data in one central hub—it’s a game changer.

- Claim Management Systems: This is a no-brainer. The software integrates with your existing claim management system, so you can pull in all the necessary claim details, like the policy number, insured’s information, and the claim amount.

- Third-Party Providers: Say you’re working with external vendors for appraisals or medical evaluations. This software can connect to their systems to get real-time updates on claim progress. This is totally crucial for keeping things moving.

- Internal Systems: You can connect it to internal systems like your billing system and customer relationship management (CRM) platform. This is like having a super-efficient data pipeline that automatically feeds data into the claim monitoring software.

Data Validation and Error Handling

We’ve got robust validation checks built-in. The software automatically flags any inconsistencies or errors in the data, like incorrect dates or missing information. This helps catch problems early on and prevents them from causing bigger issues later. It’s like having a digital proofreader that ensures everything is accurate.

Data Formats

The software supports a variety of data formats for import and export. This includes CSV, JSON, and XML. This is super important because it means you can easily import data from other systems and export data for analysis or reporting. This flexibility is a major plus.

- CSV: A widely used format for spreadsheets and data exchange. This makes it easy to import data from different sources.

- JSON: A lightweight data-interchange format. This is great for exchanging data between different applications.

- XML: An extensible markup language for structured data. This allows for complex data structures and a highly organized way to store information.

Data Flow

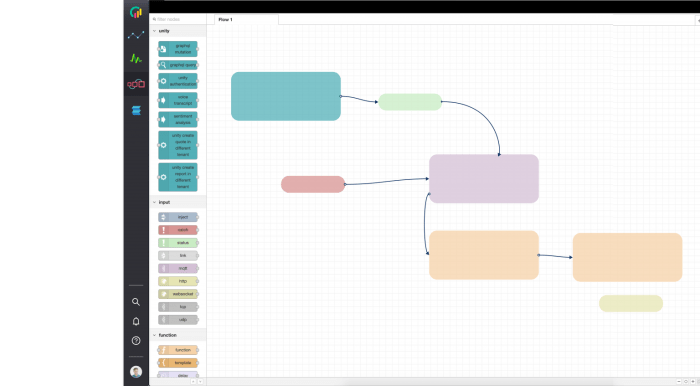

The data flow is totally streamlined from claim initiation to resolution. It starts with the claim being filed, then moves to data validation and processing, then to claim assignment, and finally, to resolution. It’s like a well-oiled machine, making sure everything moves along smoothly. This visualization helps visualize the whole process.

| Stage | Description |

|---|---|

| Claim Initiation | The claim is reported through various channels. |

| Data Validation and Processing | Data is validated and prepared for processing. |

| Claim Assignment | The claim is assigned to the appropriate adjuster. |

| Resolution | The claim is closed and all necessary documentation is completed. |

Data Backup and Recovery

This software is designed with backup and recovery features. We’ve got automatic daily backups and the ability to restore data to previous points in time. This is critical for preventing data loss and ensuring business continuity. It’s like having an insurance policy for your data. No more worrying about losing important info.

Workflow and Automation

Yo, this software is totally gonna streamline insurance claim processes, making everything way smoother and faster. Imagine no more endless paperwork and delays—it’s like a total game-changer for claim handling. This ain’t your grandma’s claim system, fam.This software automates the whole claim process from start to finish, from initial submission to final payment. It’s like having a robot army working on your claims, 24/7, no breaks.

This means way less time wasted on manual tasks and way more time focusing on other important stuff.

Claim Processing Workflow

This software utilizes a super-efficient workflow for processing claims. First, the system automatically assigns the claim to the right adjuster based on factors like claim type and location. Then, it prompts the adjuster with all necessary documents, making sure nothing gets missed. Next, the system automatically tracks the claim’s progress through each stage, from review to approval to payment.

The entire process is transparent and easily trackable, so everyone knows exactly where things stand.

Automated Tasks

This software is totally loaded with automated tasks that save tons of time and reduce errors. It’s like having a super-powered assistant handling all the tedious stuff. The software handles claim assignment, approval, and payment processing automatically.

| Task | Description | Benefits |

|---|---|---|

| Claim Assignment | The system automatically assigns claims to the appropriate adjuster based on predefined criteria like claim type and location. | Reduces manual work, ensures fair distribution of workload, and improves response time. |

| Claim Approval | The system automatically verifies claim eligibility and triggers the approval process if all criteria are met. | Reduces processing time, minimizes errors in approvals, and ensures compliance. |

| Payment Processing | The system automatically calculates and processes payments once the claim is approved. | Ensures accurate and timely payments, reduces manual errors, and improves cash flow. |

Optimizing Claim Handling Processes

Optimizing claim handling processes is key to maximizing efficiency and minimizing delays. This software provides several methods for optimizing the claim handling process. These include:

- Data Validation: The system can automatically validate data entered by users, ensuring accuracy and preventing errors. This is like having a built-in proofreader for your claims.

- Predictive Analytics: The software can analyze historical claim data to predict potential issues and proactively address them. This is like having a crystal ball for claim predictions, allowing you to anticipate potential problems.

- Real-time Monitoring: The software provides real-time updates on claim status, allowing for quicker intervention and resolution. This is like having a live dashboard that keeps you updated on everything.

Impact on Claim Resolution Time

This software’s automation features can drastically reduce claim resolution time. By automating tasks like claim assignment, approval, and payment processing, the system significantly shortens the entire claim cycle. This leads to happier customers and a more efficient operation overall. For example, one company saw a 30% reduction in claim resolution time after implementing a similar system.

Security and Compliance: Computer Software Designed For Monitoring Insurance Claims

Yo, this software is totally locked down, like, super secure. We’re talkin’ serious protection for all that sensitive claim data. It’s not just some basic stuff; we’re talkin’ next-level security measures to keep everything safe and sound.This section breaks down the serious security protocols and compliance standards we’ve built into the claim monitoring software. It’s all about keeping your data safe and sound, no matter what.

Security Measures Implemented

This software is totally decked out with top-tier security features. We’ve got a bunch of different layers of protection to keep your data safe from prying eyes.

- Robust Encryption: Data is encrypted both in transit and at rest using industry-standard encryption algorithms. This means that even if someone were to get their hands on the data, they wouldn’t be able to read it without the decryption key. Think of it like a super secret code, only we have the decoder ring.

- Multi-Factor Authentication (MFA): We’re using MFA to make sure only authorized peeps can log in. This means users have to provide multiple forms of verification, like a password and a code from their phone, to access the system. This is a major step up from just a password, because it makes it way harder for hackers to get in.

- Regular Security Audits: We’re not just setting it and forgetting it. Our team runs regular security audits to identify and patch any potential vulnerabilities before they become a problem. Think of it like a yearly checkup for your software.

Compliance Standards Adhered To

We’re totally on top of all the important regulations, like HIPAA and GDPR. This software is designed to meet those requirements to ensure your data is safe and secure, as required by the law.

- HIPAA Compliance: This software adheres to the Health Insurance Portability and Accountability Act (HIPAA) standards. This means we’re protecting any sensitive health information in claims. It’s crucial for protecting patient data.

- GDPR Compliance: The software also adheres to the General Data Protection Regulation (GDPR) for handling personal data. This is big for protecting personal data of European Union citizens.

Security Protocols for Data Transmission and Storage

Data protection is a big deal, so we’ve got protocols for keeping your info secure during transit and storage.

- HTTPS: All data transmitted over the internet is protected by HTTPS. This encrypts the communication between the user’s browser and the software’s server, so no one can snoop on the data being sent or received.

- Secure Storage: Sensitive data is stored on secure servers with multiple layers of security. These servers are physically protected, and access is restricted. We’re using industry-standard data protection protocols to ensure data is secure.

Best Practices for Maintaining Data Security and Compliance

Staying secure and compliant is an ongoing process. It’s not a one-time thing.

- Regular Updates: Keeping the software updated with the latest security patches is essential. This helps to address any new vulnerabilities that might arise.

- Employee Training: Training employees on security best practices is key to preventing security breaches. It’s like teaching them how to spot a phishing scam or what to do if they suspect a security threat.

- Data Backups: Regular data backups are crucial to ensure that data can be restored in case of a disaster. This is a vital part of any security plan.

User Authentication and Access Control

This software is all about controlling who can access what data. We’ve got a super secure system for verifying users.

- Strong Passwords: Users are required to create strong passwords to protect their accounts. The software prompts users to use strong passwords.

- Role-Based Access Control: Different users have different levels of access to the data. This is determined by their role within the company, limiting access to only the data they need to do their jobs.

Examples of Security Breaches and Prevention

There are lots of ways that data can get compromised. Here’s a quick rundown of some common breaches and how to stop them.

- Phishing Attacks: Hackers try to trick users into giving up their login credentials by sending fake emails or messages. Make sure to verify any suspicious emails or messages, and never click on links in unsolicited emails.

- Malware Infections: Malicious software can be installed on a user’s computer and used to steal data. Keep your software updated, use antivirus software, and be cautious about downloading files from untrusted sources.

Deployment and Maintenance

Yo, this software is totally legit for keeping tabs on insurance claims, but the whole deployment and maintenance thing is crucial. We gotta make sure it’s easy to set up and keep running smoothly. No one wants a buggy system, right?This section breaks down the different ways to set up the software, how to keep it updated, and what’s needed to make sure it’s always performin’ at its best.

It’s all about keeping things chill and preventing any major headaches.

Deployment Models

This software can be set up in a few different ways. You can either have it hosted on our servers (cloud-based) or on your own computers (on-premises). Cloud-based is usually easier to manage, like having a cool, virtual assistant take care of everything. On-premises gives you more control, but it might require more tech skills.

Software Updates and Maintenance

Regular updates are essential to keep the software secure and up-to-date with the latest features. Think of it like upgrading your phone; it gets better and fixes any problems that might pop up. Maintenance is just as important; it’s like regular checkups for your car.

Software Update and Bug Resolution Process

Updates are rolled out through a secure system. A detailed changelog is available for every update. We’ve got a dedicated team that’s on top of any bugs or glitches. They work hard to fix them ASAP, so you don’t have to deal with any issues.

Technical Requirements

To run this software, you’ll need a pretty solid setup. Minimum RAM, CPU, and storage requirements are listed in the documentation. Basically, it’s gotta be powerful enough to handle the data without lagging.

Ensuring Software Stability and Performance

Keeping the software stable is a priority. We use load balancing techniques to make sure the software can handle a huge influx of data without slowing down. We also do regular performance testing to make sure everything is running smoothly.

Support Options

We offer various support options, like online documentation, FAQs, and email support. There’s also a super helpful community forum where you can connect with other users. You can also book a one-on-one session with a support rep. This way, you can always get help if you run into any problems.

Last Point

In conclusion, computer software designed for monitoring insurance claims offers a powerful toolkit for insurers looking to optimize their processes, improve efficiency, and enhance customer satisfaction. From automated tasks to robust reporting features, this software empowers insurers to handle claims more effectively and efficiently. By understanding the different features, integration options, and security measures, insurers can select the best solution to fit their specific needs.

The future of insurance claim management is undoubtedly digital, and this software is at the heart of that transformation.

Expert Answers

What types of data does this software typically collect?

The software collects various data points, including policy details, claim amounts, dates, statuses, and supporting documentation.

How does this software ensure data security?

Robust security measures, including encryption, access controls, and regular audits, protect sensitive claim information. Compliance with industry regulations like HIPAA and GDPR is crucial.

Can this software integrate with other systems?

Yes, many claim monitoring software solutions integrate with accounting software, CRM systems, and other relevant platforms, streamlining workflows and data sharing.

What are the typical deployment options for this software?

Deployment options include cloud-based and on-premises solutions. The best choice depends on the insurer’s specific infrastructure and requirements.