Insuring a car owned by a trust presents unique challenges and considerations. This guide dives deep into the intricacies of securing appropriate coverage for vehicles held within a trust, exploring legal implications, insurance options, and claim procedures. Navigating the complexities of trust ownership and its impact on car insurance can be daunting, but this comprehensive resource provides a clear and accessible path to understanding the process.

From understanding the various types of trusts and their implications for insurance to exploring the specific policy wording and claim procedures, this guide simplifies the often-overlooked aspects of insuring a trust-owned vehicle. We’ll examine coverage options, limitations, and the crucial role of the trustee, ensuring a thorough understanding of the financial and legal responsibilities involved.

Understanding Trust Ownership

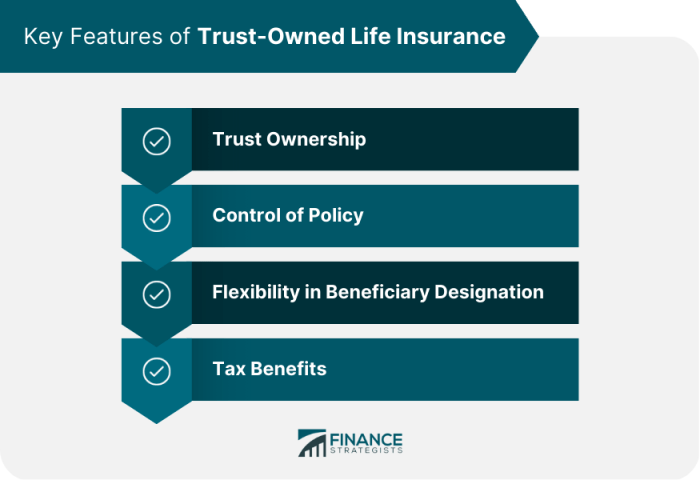

Navigating the complexities of trust ownership for vehicle insurance requires a clear understanding of the legal implications. A trust, as a legal entity distinct from its beneficiaries, can absolutely own a vehicle, but this ownership brings specific considerations for insurance. This necessitates a nuanced approach to policy acquisition and maintenance.Trusts are designed to manage assets for beneficiaries. Understanding the specific type of trust and its structure is critical to determining insurance responsibilities.

Different types of trusts have varying levels of complexity, impacting how liability and coverage are handled.

Legal Implications of a Trust Owning a Vehicle

A trust’s ownership of a vehicle has significant legal implications, especially for insurance purposes. The trust, as the legal owner, is primarily responsible for ensuring the vehicle is properly insured. This responsibility often falls upon the trustee, the individual managing the trust’s assets. However, the specific legal and financial implications may differ depending on the type of trust.

Types of Trusts and Their Impact on Car Insurance

Trusts are categorized into various types, each with distinct characteristics that affect insurance. Understanding these differences is crucial to accurately assessing insurance needs.

- Revocable Trusts: These trusts allow the grantor (the person creating the trust) to change or revoke the trust’s terms. The grantor typically maintains control over the vehicle and, in many cases, remains responsible for insurance until the trust is properly established as the legal owner.

- Irrevocable Trusts: These trusts, once established, cannot be changed or revoked. The grantor relinquishes control, and the trust becomes the legal owner of the vehicle. This complete transfer of ownership necessitates updating insurance policies to reflect the trust as the named insured.

- Living Trusts: These trusts are established during the grantor’s lifetime. Similar to irrevocable trusts, these trusts require a formal transfer of vehicle ownership and necessitate a change in the insurance policy to reflect the trust as the legal owner.

- Testamentary Trusts: These trusts are established in a will and take effect upon the grantor’s death. As with other trust types, the vehicle transfer to the trust and subsequent insurance adjustments need to occur promptly to avoid potential gaps in coverage.

Examples of Common Trust Structures and Their Insurance Implications

Different trust structures have distinct implications for insurance.

Navigating the complexities of insuring a car held within a trust often necessitates a nuanced understanding of legal stipulations. Consider, for example, the diverse menu options available at house of pizza piedras menu , a testament to the intricacies of diverse offerings. Ultimately, securing appropriate coverage for a trust-owned vehicle requires careful consideration of the specific stipulations and potential liabilities involved.

- A trust established to hold the assets of a business: This structure might involve a corporation, a partnership, or a limited liability company (LLC). The trust, as the legal owner, would be responsible for securing vehicle insurance in the name of the trust.

- A trust established to hold the assets of a family: This type of trust often involves intricate details regarding beneficiary rights and responsibilities. The trustee, designated to manage the trust, is often responsible for ensuring the vehicle is properly insured and the policy reflects the trust’s ownership.

Legal Documents Needed to Prove Trust Ownership

Insurance companies require documentation to confirm the trust’s ownership of the vehicle.

- Trust Agreement: This document Artikels the terms of the trust, including the trustee’s responsibilities and the beneficiaries’ rights. This document is critical for verification.

- Transfer of Ownership Documents: These documents, such as a bill of sale, are essential to demonstrate the vehicle’s legal transfer to the trust.

- Trustee’s Designation: This confirms the trustee’s authority to act on behalf of the trust, and it’s crucial for insurance purposes.

Responsibilities of Trustee and Beneficiary Regarding Car Insurance

The trustee and beneficiaries have distinct roles in ensuring proper vehicle insurance.

- Trustee Responsibilities: The trustee, as the manager of the trust, is primarily responsible for ensuring the vehicle is properly insured. This includes obtaining and maintaining appropriate insurance coverage in the trust’s name.

- Beneficiary Responsibilities: Beneficiaries, though not directly responsible for the insurance, should understand their rights and the potential implications of the trust’s ownership structure. They are often informed about the vehicle’s insurance status.

Insurance Coverage Considerations

Navigating the complexities of trust-owned vehicle insurance requires a nuanced understanding of typical coverage options, potential limitations, and crucial endorsements. This section delves into the specifics, offering clarity on choosing appropriate liability limits and avoiding coverage gaps that could leave your trust vulnerable.A comprehensive understanding of the insurance landscape specific to trust-owned vehicles is essential. Proper coverage selection protects the trust’s assets and ensures compliance with any stipulations Artikeld in the trust document.

Typical Insurance Coverage Options

Trust-owned vehicles are eligible for the standard array of auto insurance coverages, including liability, collision, comprehensive, and uninsured/underinsured motorist protection. These coverages provide protection against various risks, from accidents to damages caused by weather or vandalism. The specific options and extent of coverage will vary depending on the trust’s location and the individual policies of the insurer.

Limitations and Exclusions

Insurance policies often contain limitations and exclusions that might apply to trust-owned vehicles. These might include restrictions based on the trust’s specific legal structure, the vehicle’s age, or its use. For example, vehicles used primarily for commercial purposes may have limited coverage. Policy terms should be reviewed carefully to avoid surprises and ensure appropriate protection.

Importance of Specific Endorsements

Certain endorsements are critical for trust-owned vehicles. These might include endorsements for named insured (the trust itself) or for specific trust beneficiaries, depending on the terms of the trust. This clarifies who is covered under the policy and the responsibilities each party has in the event of a claim. A clear understanding of these endorsements is crucial to avoiding disputes or coverage gaps.

Implications of Gaps in Coverage

Gaps in coverage can expose the trust to significant financial risks. For instance, a lack of comprehensive coverage could leave the trust responsible for substantial repairs or replacements if the vehicle is damaged due to factors not covered by the policy. Thorough review of the policy terms is vital to identify and address potential coverage gaps.

Choosing Appropriate Liability Limits

Selecting appropriate liability limits is a critical aspect of trust-owned vehicle insurance. Factors to consider include the trust’s assets, the vehicle’s value, and potential legal ramifications of an accident. The amount of liability coverage must be sufficient to protect the trust’s assets from claims in the event of a significant accident. Consult with an insurance professional to determine suitable limits.

Common Insurance Coverages for Trust-Owned Vehicles

| Coverage Type | Description | Premium Factors | Exclusions |

|---|---|---|---|

| Liability | Covers bodily injury and property damage caused to others in an accident. | Vehicle type, location, and driving history | Intentional acts, pre-existing conditions, and specific exclusions in the policy. |

| Collision | Covers damage to the trust’s vehicle regardless of who caused the accident. | Vehicle type, age, and driver’s history | Pre-existing damage, and damage from certain types of events. |

| Comprehensive | Covers damage to the trust’s vehicle from events other than collisions, such as vandalism, theft, or weather events. | Vehicle type, location, and security measures | Pre-existing damage, intentional acts, and exclusions for specific events. |

| Uninsured/Underinsured Motorist | Covers the trust’s losses if the at-fault driver is uninsured or underinsured. | Vehicle type, location, and driving history | Intentional acts, and exclusions Artikeld in the policy. |

Claims and Disputes

Navigating claims and disputes involving trust-owned vehicles requires a meticulous understanding of the legal framework governing trusts and insurance policies. A clear protocol for handling these situations is crucial to protect the trust’s assets and ensure a smooth resolution. The procedures must be transparent and follow established legal precedents to avoid complications and potential legal challenges.The complexities of trust ownership often introduce unique challenges in the claims process.

These complexities arise from the legal separation between the trust and its beneficiaries. Understanding these nuances is vital for ensuring the claims process is handled correctly, efficiently, and legally.

Claim Filing Procedures for Trust-Owned Vehicles

Filing a claim when a trust-owned vehicle is involved requires a specific approach. The trustee, acting on behalf of the trust, is the primary point of contact with the insurance company. The claim form needs to clearly identify the trust as the vehicle owner. Failure to follow the established procedures can delay or even jeopardize the claim.

Potential Challenges in Claims Involving Trust-Owned Vehicles

Several potential challenges may arise during a claim involving a trust-owned vehicle. These include identifying the appropriate trustee with the authority to act on behalf of the trust, establishing proof of trust ownership, and ensuring the claim aligns with the terms of the trust agreement and the insurance policy. Discrepancies in the documentation or lack of clear communication between the parties can further complicate the process.

For example, if the trustee has limited authority or is unsure about the claim’s validity, it could hinder the process significantly.

Necessary Documentation for Trust-Owned Vehicle Claims

Comprehensive documentation is essential for a successful claim. This includes the trust’s legal documents, such as the trust agreement, trustee appointment documents, and proof of insurance coverage for the trust-owned vehicle. The insurance policy itself should be carefully reviewed for stipulations relevant to trust-owned vehicles. Supporting documents like police reports, accident reports, and repair estimates are also necessary.

The documentation needs to be organized and presented in a manner that clearly demonstrates the trust’s ownership and the validity of the claim.

Role of the Trustee in Claims Involving Trust-Owned Vehicles, Insuring a car owned by a trust

The trustee plays a critical role in handling claims. The trustee must be familiar with the trust agreement and have the authority to act on behalf of the trust. They need to ensure the claim is filed promptly and accurately. The trustee should be adept at communicating with the insurance company and representing the trust’s interests. This responsibility includes ensuring the claim aligns with the trust’s objectives and complies with all relevant legal requirements.

Dispute Resolution Process for Trust-Owned Vehicles

A dispute resolution process should be established for potential disagreements. This may involve mediation or arbitration, depending on the specifics of the dispute and the terms of the trust agreement. Clear communication between the trustee, the insurance company, and any involved beneficiaries is crucial. This approach aims to facilitate a fair and efficient resolution.

Claim Process Flowchart for Trust-Owned Vehicles

| Step | Action | Parties Involved | Documentation |

|---|---|---|---|

| 1 | Identify the trustee authorized to act on behalf of the trust. | Trust, Trustee, Beneficiaries (if applicable) | Trust agreement, trustee appointment documents |

| 2 | Gather necessary documentation (e.g., trust agreement, insurance policy, police report, repair estimates). | Trustee | Trust documents, insurance policy, accident reports, repair estimates |

| 3 | File a claim with the insurance company, ensuring the trust is clearly identified as the vehicle owner. | Trustee, Insurance Company | Completed claim form, supporting documentation |

| 4 | Communicate with the insurance company regarding the claim’s progress. | Trustee, Insurance Company | Correspondence with the insurance company |

| 5 | Address any disputes or disagreements with the insurance company. | Trustee, Insurance Company, potentially legal counsel | Supporting documentation, relevant legal precedents |

| 6 | Engage in dispute resolution processes (e.g., mediation, arbitration). | Trustee, Insurance Company, potentially legal counsel, mediator/arbitrator | All previous documentation, mediator/arbitrator’s findings |

Legal and Financial Implications

Navigating the complexities of trust-owned vehicle insurance extends beyond the policy itself. Understanding the legal and financial implications is crucial for trustees and beneficiaries alike. These considerations encompass tax implications, trustee responsibilities, potential disputes, and the various legal structures available. Thorough examination of these areas ensures the smooth operation of the trust and protects all involved parties.

Navigating the complexities of insuring a car owned by a trust often requires a meticulous approach, similar to crafting a precise nutritional regimen. One must consider the specific legal framework surrounding the trust, ensuring all facets of ownership are accurately reflected in the policy. This careful consideration, like a meticulously followed recipe for 22 calorie formula, recipe for 22 calorie formula , necessitates a deep understanding of the intricacies involved.

Ultimately, securing appropriate coverage remains paramount for the protection of the trust’s assets.

Tax Implications of Trust-Owned Vehicles

Trust-owned vehicles are subject to specific tax rules that differ from those for personally owned vehicles. These variations can impact the trust’s overall financial picture. Federal and state tax laws governing trust income, deductions, and property taxes need to be meticulously considered to avoid potential penalties. Accurate record-keeping and consultation with a qualified tax professional are vital to ensure compliance.

Financial Responsibilities of the Trustee

The trustee holds significant financial responsibilities when managing a trust-owned vehicle. These responsibilities include, but are not limited to, ensuring appropriate insurance coverage, maintaining the vehicle’s upkeep, and adhering to all legal requirements. Proactive management and careful financial planning are essential to fulfill these duties effectively. Failure to adhere to these responsibilities can result in legal ramifications.

Furthermore, the trustee is liable for any financial losses or penalties arising from non-compliance.

Legal Recourse in Disputes Related to Trust-Owned Vehicles

Potential disputes concerning trust-owned vehicles may arise regarding insurance claims, maintenance, or even the trust’s administration. Clear documentation, detailed records, and adherence to the trust agreement are essential in preventing disputes. Legal recourse options may include arbitration, mediation, or litigation, depending on the specific situation and jurisdiction. It is crucial to consult with legal counsel familiar with trust law to explore appropriate avenues of resolution.

Legal Structures for Trust-Owned Vehicles

Several legal structures can govern the ownership of a vehicle within a trust. These structures can influence insurance requirements, tax implications, and the trustee’s responsibilities. The most common structures include a simple trust, a living trust, or a testamentary trust. Each structure carries unique characteristics and implications. Proper legal counsel can guide the selection of the most suitable structure for the specific circumstances.

Jurisdictional Variations in Trust-Owned Vehicle Insurance

Insurance regulations regarding trust-owned vehicles vary across jurisdictions. Different states and countries may have specific laws concerning the types of insurance coverage required, the process for filing claims, and the handling of disputes. For example, some jurisdictions may have more stringent regulations on liability coverage for trust-owned vehicles compared to others. Thorough research and consultation with local legal experts are essential to ensure compliance.

This necessitates a tailored approach for each jurisdiction.

Common Legal Terms

“Trustee,” “beneficiary,” “trust agreement,” “liability coverage,” “comprehensive coverage,” “collision coverage,” “asset protection,” “fiduciary duty,” “court-appointed trustee,” “trust deed,” “dispute resolution,” and “arbitration” are essential terms in the context of trust-owned vehicles.

Illustrative Scenarios

Navigating the complexities of insuring a trust-owned vehicle requires a nuanced understanding of the interplay between trust structures, legal procedures, and insurance policies. This section provides concrete examples to illustrate the practical implications of various scenarios, offering a practical guide for navigating the often-uncharted territory of trust vehicle insurance.

Trust-Owned Vehicle Accident

A trust-owned vehicle, registered in the name of the “Smith Family Trust,” is involved in a collision. The accident resulted in significant damage to both the trust vehicle and another party’s vehicle. The insurance policy, held by the trust, covers the damages to the trust vehicle. Crucially, the policy’s liability coverage will determine the extent to which the trust is responsible for damages to the other vehicle and its occupants.

The insurance company will likely investigate the accident and assess the damages before processing the claim. Proper documentation, including police reports and witness statements, is paramount in this process. The trust’s legal counsel should be consulted to ensure all relevant legal procedures are followed.

Transferring Trust-Owned Vehicle Ownership

Transferring ownership of a trust-owned vehicle often requires a formal document signed by the trustee(s). This transfer can trigger a change in the insurance policy. For instance, if the trust vehicle is transferred to a new trustee, the insurance policy might require a notification to the insurance provider. This update ensures the policy accurately reflects the ownership change.

Failure to update the insurance policy may lead to issues if a claim arises, as the insurance company might not recognize the trust as the legitimate owner.

Change in Trustee

A change in trustee for the trust managing the vehicle necessitates a review of the insurance policy. The new trustee must promptly notify the insurance provider of the trustee change. This action ensures that the insurance policy accurately reflects the current trustee’s authority to act on behalf of the trust. The trustee must provide the insurance company with the necessary documentation to confirm the trustee’s authority, such as a copy of the trust document.

Ensuring Insurance Compliance

Compliance with insurance requirements for trust-owned vehicles hinges on meticulous record-keeping and prompt communication with the insurance provider. Crucially, the trust’s insurance policy should clearly delineate the coverage details, including liability limits, collision coverage, and comprehensive coverage. Reviewing the policy regularly ensures that the coverage remains appropriate for the vehicle and its usage.

Types of Damages and Insurance Claims

Damages to a trust-owned vehicle can range from minor scratches to total loss. Insurance claims for these damages are processed based on the policy’s coverage. A comprehensive policy covers damages caused by various incidents, such as accidents, vandalism, or natural disasters. The insurance company assesses the damage and determines the amount payable according to the policy terms.

Proper documentation, such as repair estimates and photos, is essential for processing the claim.

Trust-Owned Vehicle: A Unique Perspective

A trust-owned vehicle is a vehicle registered in the name of a trust, a legal entity. Its unique characteristic lies in the separation of ownership from the individuals managing the trust. This separation can create complexities in insurance claims and policy management. The insurance policy must explicitly address the trust as the vehicle’s owner. A trustee’s actions must be authorized by the trust’s terms and the insurance policy to ensure legitimate claims.

This structure can potentially lead to more intricate procedures for reporting accidents, transferring ownership, or handling claims.

Ending Remarks: Insuring A Car Owned By A Trust

In conclusion, insuring a car owned by a trust demands careful consideration of legal structures, insurance coverage, and claim procedures. This guide has provided a comprehensive overview, outlining the key considerations and practical steps to secure appropriate insurance. By understanding the nuances of trust ownership and insurance, trustees and beneficiaries can confidently navigate the complexities of protecting their trust-owned vehicle.

Questions Often Asked

What are the different types of trusts that can own a vehicle?

Trusts can take various forms, including living trusts, testamentary trusts, and charitable trusts. Each type may have specific implications for insurance, as they differ in their legal structures and responsibilities.

What documentation is required to prove trust ownership for insurance purposes?

The required documentation will vary depending on the jurisdiction and the specific trust structure. Typically, this includes trust documents, proof of ownership transfer, and possibly a court order.

What are the common exclusions in car insurance policies for trust-owned vehicles?

Exclusions may relate to pre-existing damage, use of the vehicle outside the trust’s intended purpose, or specific activities that fall outside typical coverage.

How do tax implications affect insuring a trust-owned vehicle?

Tax implications can vary depending on the trust’s structure and jurisdiction. Consult with a tax professional for personalized advice.